As the rupee continues to explore new records against the US dollar, stakeholders are now concerned about the maximum that the local unit will fall before holding its ground.

Warnings of a massive drop in the rupee are flaring up, with some analysts forecasting another 20% decline is possible. Economists believe that the rupee will likely fall further if Pakistan Tehreek-e-Insaf (PTI) Chairman Imran Khan and the coalition government continue to clash and if the International Monetary Fund (IMF) chooses not to provide loans.

Adil Ghaffar, chief executive officer at Premier Financial Services Pvt in Karachi, told Bloomberg that the rupee may slump to as low as 350 per dollar in June if Pakistan fails to secure the loan.

“The rupee trajectory remains subject to considerable uncertainty as market sentiment is fragile,” Farooq Pasha, an economist in Karachi, said, adding that politics will remain the key risk in the near-term until the elections.

The stakeholders are also concerned that the weakening currency could open up Pakistanis to a new round of inflationary impact, which will hit the lower and middle classes the hardest.

No sector of the economy would be immune from the fallout of the steep devaluation of the local currency — which has lost about 20% this year, among the worst performers in the world.

The rupee has gained and lost value in the past and it will do so in the future as well but this time the curve has maintained its upward trend since quite a few months now.

Economists Ankur Shukla and Abhishek Gupta, in an analysis given on Bloomberg Economics, have compiled the reason why the Pakistani rupee was so weak.

The analysts said that the capital is fleeing Pakistan because there is a growing risk that the IMF will not deliver a bailout, which is needed for the country to avoid default in the fiscal year starting from July. They suspected that political unrest was probably one of the reasons the Fund was baulking as the aid has been stalled since November.

They also pointed out the impact of political tumult on the rupee, stating that the country’s leadership has been unstable since Pakistan Tehreek-e-Insaf (PTI) Chairman Imran Khan was ousted as the prime minister via a no-confidence motion vote in April last year.

“Khan’s arrest this month has escalated the face-off between him and the government, as well as the army,” they noted, recalling that the rupee plunged to a record low of 299 per dollar after Khan’s jailing but recouped its losses and settled at 285 after his release.

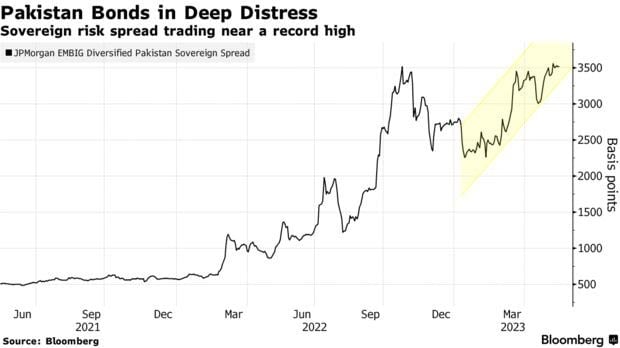

Moreover, bond investors are also growing more nervous, with the extra yield they demand to hold Pakistan’s dollar bonds over US Treasuries climbing above 35% points to a record this month.

Pakistan’s dollar bonds are trading at distressed levels, with notes due in 2031 quoted at about 34 cents on the dollar.

The country’s dollar stockpile, which stood at $4.3 billion in mid-May, is also not enough to cover even one month of imports despite heavy restrictions.